- Many traders believe their trading skill level will improve if they spend time analyzing charts and studying books. It is not always the case. Find out why.

How to Become a Better Trader

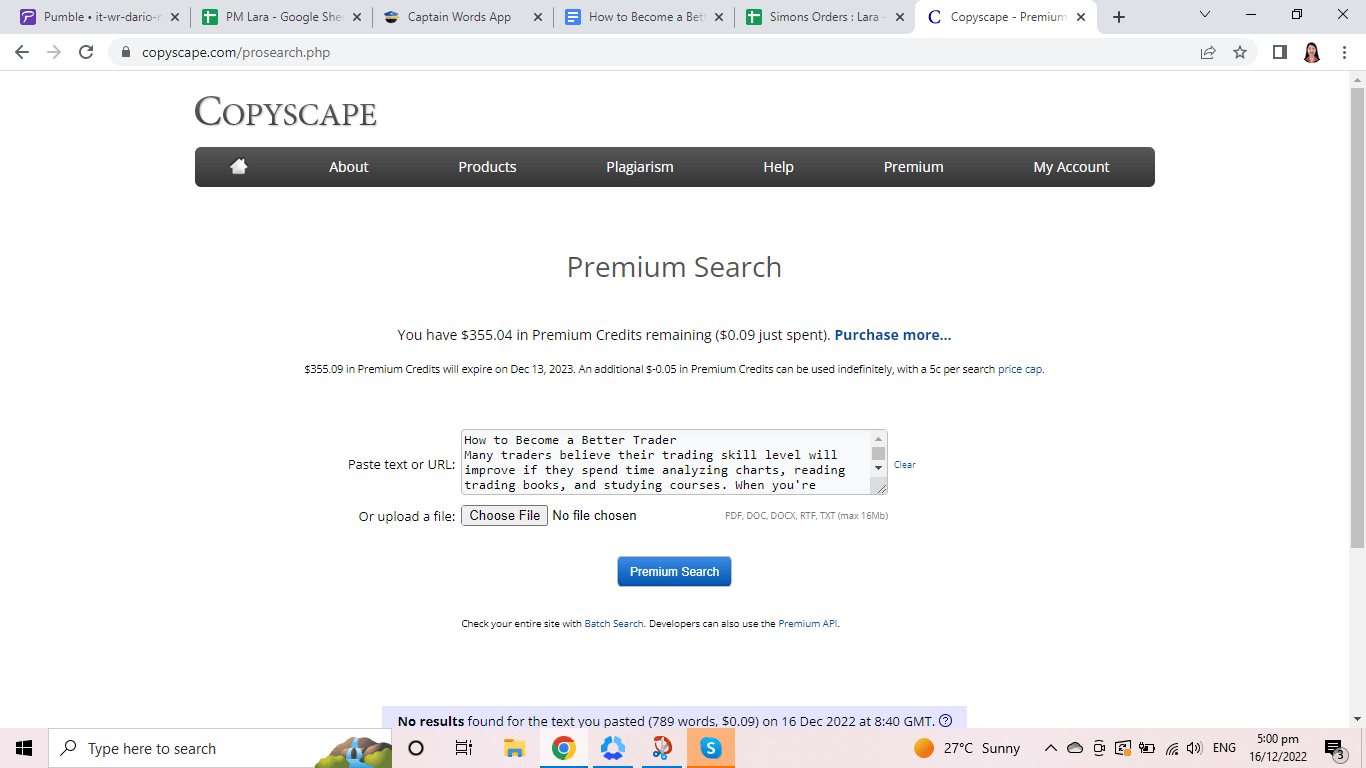

Many traders believe their trading skill level will improve if they spend time analyzing charts, reading trading books, and studying courses. When you’re getting started with trading, putting in the hours is imperative since there’s a lot to learn. However, hours don’t always translate into profits. It will only worsen if you repeat the same mistakes and do the same thing every time. You will be able to improve if you take calculated and repeated actions. If you want to improve your trading performance today, here are a few tactics you should implement.

Use The Right Indicator

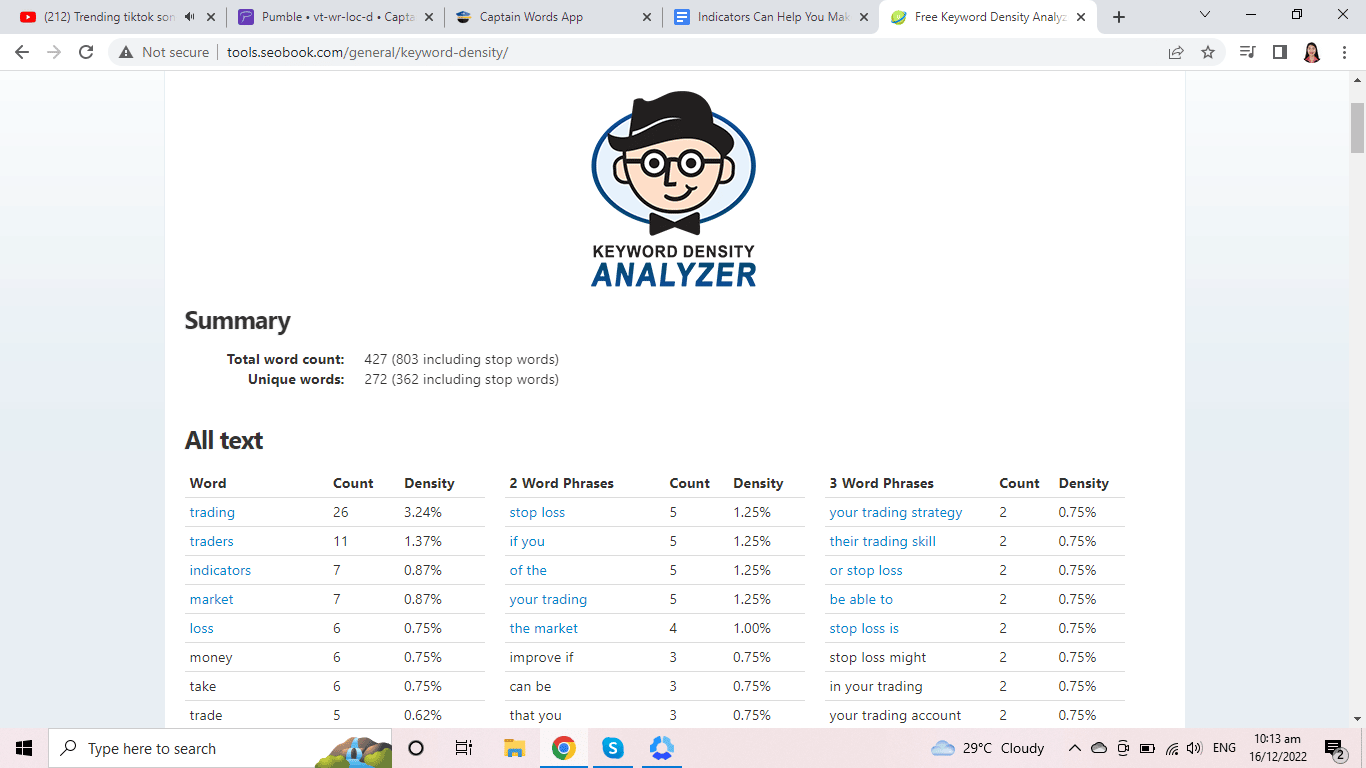

Technical traders use the best crypto indicators as part of their strategy. You might be able to gain more insight into price trends when coupled with appropriate risk management strategies. Traders can use trading indicators to identify specific signals and trends within the market by plotting them as lines on a price chart.

Leading and lagging indicators represent different types of indicators. Leading indicators predict price movements in the future, while lagging indicators show the momentum over the past. In order to use technical analysis effectively in your trading strategy, you must study a variety of trading indicators, regardless of whether you’re trading forex, commodities, or shares.

Make Sure You Always Trade With a Plan

Every trading plan contains rules defining how a trader enters, exits, and manages money. With the demo account, it is possible to test a trade idea or a strategy without putting real money at risk. Using historical data, you can determine whether your trading strategy is viable. It is referred to as backtesting, and backtesting a trading plan that shows promising results can lead to real money trading once the plan has been fully developed.

Put Technology to Use to Your Advantage

The trading industry is highly competitive. Make sure that you have full access to technology available and take full advantage of it. Trading platforms allow traders to view and analyze markets in many different ways. Analyzing historical data before implementing an idea prevents costly errors.

Monitoring trades via a smartphone allows you to get market updates wherever you go. High-quality internet connections, one of the technologies we take for granted, can dramatically enhance trading efficiency. Trading can be both fun and rewarding if you use technology effectively and stay on top of the market and new products.

Take Advantage of the Market’s Learning Opportunities

Never stop learning, so you must continually try and educate yourself. Every day, traders must strive to learn more. Market understanding is a lifelong journey. It will help if you remain diligent in your efforts to stay on top of the latest developments in the market. Trading can be enhanced by sound research, including:

- Understanding how economic reports affect the market.

- Sharpening your instincts and learning the nuances can be accomplished through focus and observation.

- World politics and economic trends, including the weather, influence markets.

- Traders are better prepared for the future when they understand the past and current markets well. So traders operate in a dynamic environment.

Don’t Take Any Risks That You Can’t Afford

You must ensure that your trading account has all the cash you need to trade before you use real cash. The money you put in your trading account money shouldn’t be for school tuition for the kids or mortgage payments. There is nothing more traumatizing than losing money, and the situation is even more problematic if the capital was never intended to be risked.

Put a Stop or Limit Loss in Place at All Times

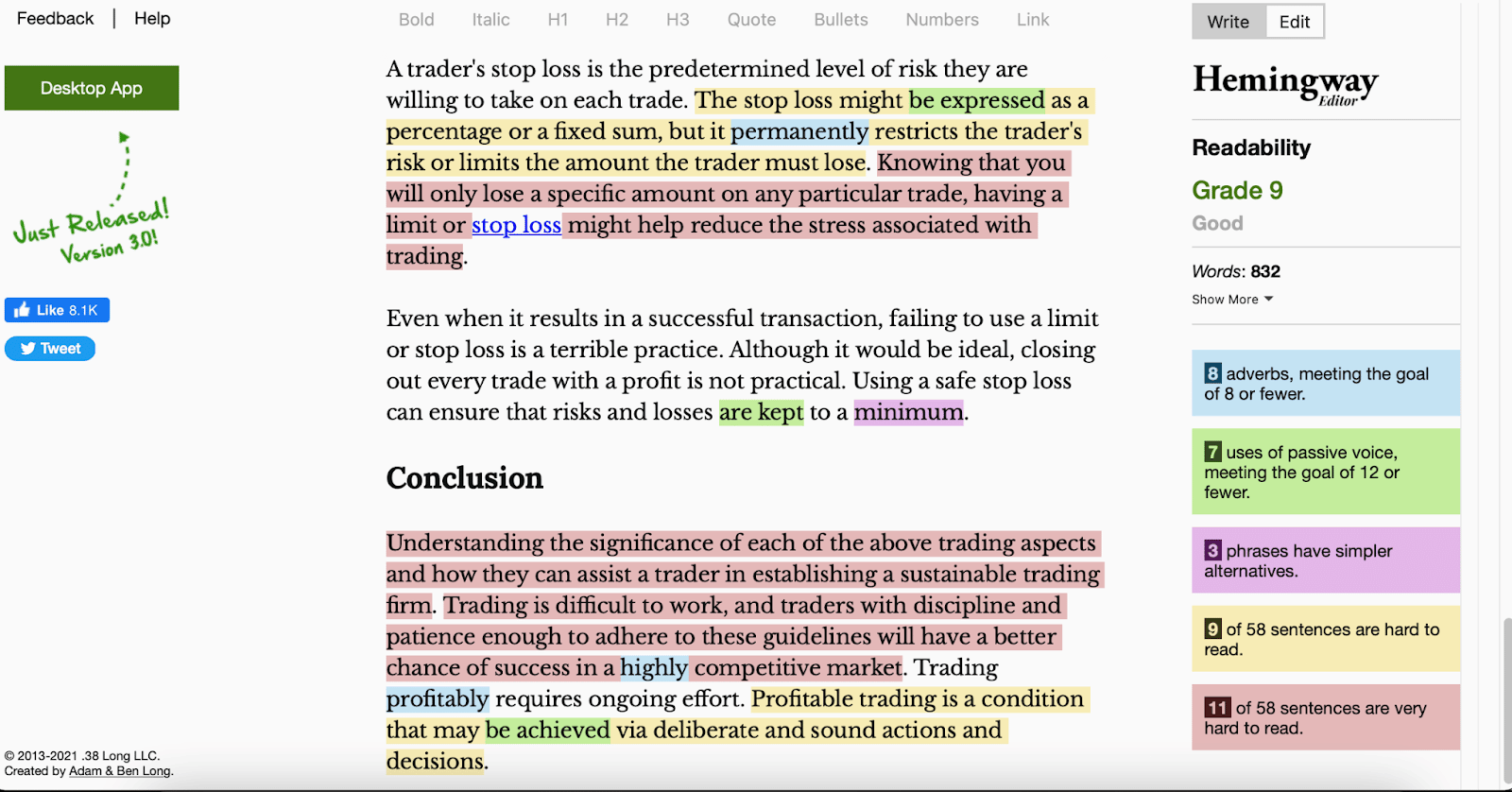

A trader’s stop loss predetermines the level of risk they are willing to accept when making a trade. Stop loss might take the form of a percentage or a fixed sum, but it permanently restricts the trader’s risk or limits the amount the trader must lose. Knowing that you will just lose a specific amount on a particular trade, having a limit or stop loss can help reduce trading anxiety.

Even when it results in a successful transaction, failing to use a limit or stop loss is a terrible practice. Although it would be ideal, closing out every trade with a profit is not practical. Using a safe stop loss can ensure that risks and losses are kept to a minimum.

Conclusion

Understanding the significance of each of the above trading aspects and how they can assist a trader in establishing a sustainable trading firm. Trading is difficult to work, and traders with discipline and patience enough to adhere to these guidelines will have a better chance of success in a highly competitive market. Trading profitably requires ongoing effort. Profitable trading is a condition that may be achieved via deliberate and sound actions and decisions.