It’s no secret that the best way to grow your financial portfolio is by investing online. By doing so, you can open up a world of opportunity and potential growth that wouldn’t be available to you if you were stuck solely with traditional investment methods. However, many people are hesitant to take the plunge into online investing for a variety of reasons.

We’ll explore some of the most common objections to online investing and provide tips on how to overcome them. So whether you’re a first-time investor or someone who’s been dabbling in online investing for a while, read on for some valuable advice!

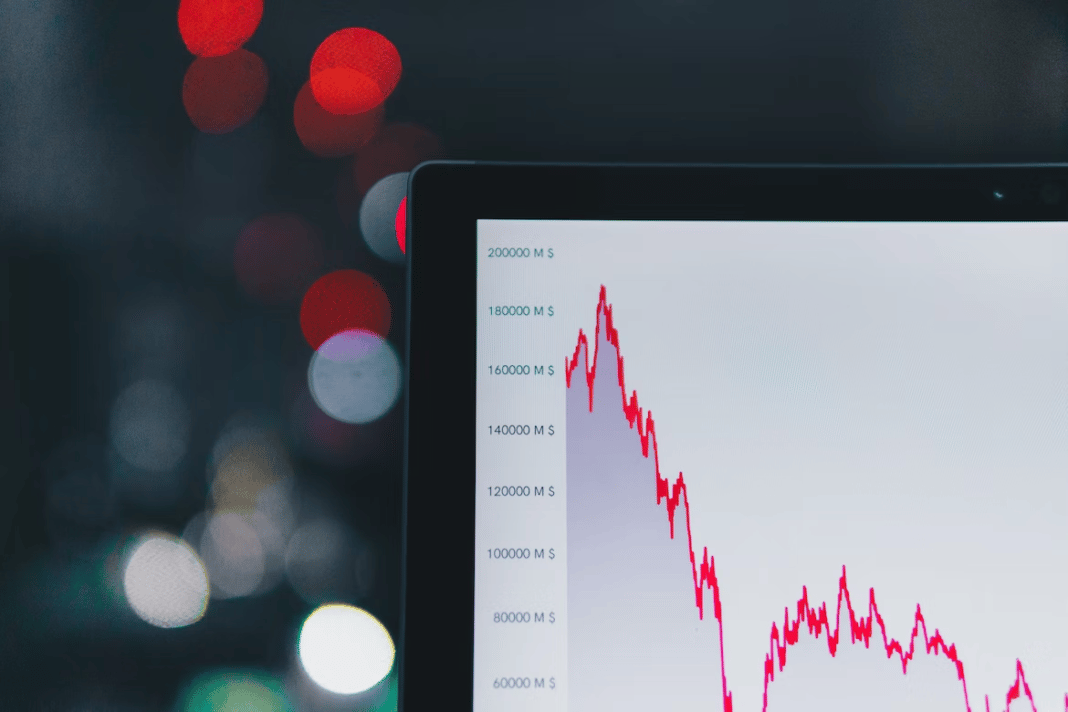

1. Use Info Charts and Graphs to Make Informed Decisions

To make the best decisions when it comes to online investing, you need to have access to accurate information. Thankfully, most reputable investing sites offer real-time data that can be easily accessed and analyzed. Look for interactive graphs, charts, and other visuals that will give you a good sense of how the stock market is performing.

This will help you make more informed decisions about your investments. By looking at a nasdaq index chart you can get an idea of how the market is performing in general and whether individual stocks are worth investing in. And, you can use the same charts to watch for trends and make decisions about when it’s time to buy or sell.

2. Research Different Investment Strategies

Investing is not a one-size-fits-all endeavor, so you should take your time researching different investment strategies to find the one that works best for you. Start by considering your goals and how much risk you’re willing to expose yourself to. Do some research into different asset classes and read up on how each type of investment works.

You may be surprised at some of the options available to you! Decide which strategy aligns with your long-term financial objectives before jumping in head first. If you’re still unsure of what to do, consider consulting with a financial adviser.

3. Set Limits and Stick to Them

Once you’ve chosen an investment strategy that works for you, it’s important to be disciplined and stick to your limits. Too often, investors get caught up in the moment and make impulsive decisions that lead to costly mistakes.

Avoid this by setting yourself limits on how much risk you’re willing to take on, as well as how much money you can afford to invest at any given time. And don’t forget – having a plan is half the battle! Make sure you know when it’s time to buy or sell before taking action.

4. Make Sure You Choose a Reputable Online Platform

The internet is full of potential investment opportunities, but it’s important to be wary of scams. Make sure you’re using a reputable online platform that offers a secure environment for your investments.

Look for sites with strong customer service and security features such as encryption, two-factor authentication, and backup options. Finally, read the terms and conditions to make sure you understand exactly what you’re signing up for.

By following these tips, you can start investing online with confidence. With the right information and strategies in place, you’ll soon be on your way to growing your financial portfolio.

And, make sure to take advantage of the wealth of resources available on reputable investing sites to help you along the way.