Michel Jeanjean is facing a 167% tax increase on his property in the Costa Blanca – which he has said is a ‘scandal’.

“I am Belgian and a non-resident owner of a small Villa on the Costa Blanca,” said Michel, who lives in Braine-l’Allued.

“The Belgian tax office has decided to review the cadastral income on this property – that has never been rented – and to increase and index it.

“This leads to him facing an increase of more than 167%, without being unable to deduct the SUMA or other Spanish taxes overpaid or the 40% of the fees,” he said

The European Court of Justice imposed a lump-sum fine and penalties for each day that the Belgian tax authorities would continue to maintain a difference in tax treatment for rental income, depending on whether the property is located in Belgium or abroad, including Spain.

In order to comply with EU Law and to ensure equal tax treatment for tax residents of Belgium with property located abroad, the Belgian Federal Government proposed to attribute a cadastral income – kadastraal inkomen/revenu cadastral – to each foreign real estate.

The draft legislation was approved and resulted in the Law of 17 February 2021, published in the Belgian Official Gazette on 25 February 2021.

Up to tax year 2021, income of 2020, a cadastral income was only attributed to properties located in Belgium.

If a property is located in Belgium or abroad, and is rented out, the owner of the property – tax resident of Belgium – will be taxed, based on the actual received rental income, not on a cadastral income.

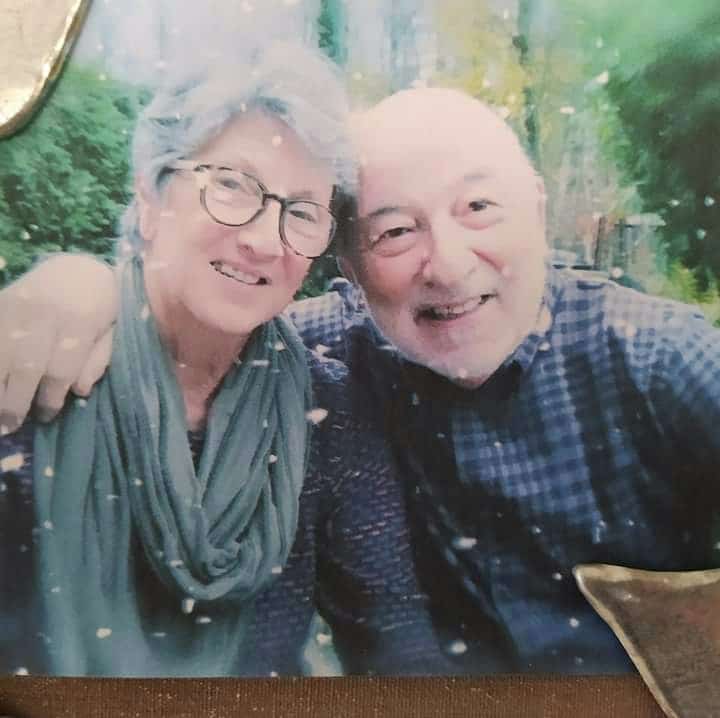

Speaking to Les Belges à Torrevieja, Michel said: “My wife and I each face an increase, from €63 of charges to €590, which is a difference of more than €1,054. It is a scandal.”